Ðåôåðàòû ïî áèîëîãèè

Ðåôåðàòû ïî ýêîíîìèêå

Ðåôåðàòû ïî ìîñêâîâåäåíèþ

Ðåôåðàòû ïî ýêîëîãèè

Êðàòêîå ñîäåðæàíèå ïðîèçâåäåíèé

Ðåôåðàòû ïî ôèçêóëüòóðå è ñïîðòó

Òîïèêè ïî àíãëèéñêîìó ÿçûêó

Ðåôåðàòû ïî ìàòåìàòèêå

Ðåôåðàòû ïî ìóçûêå

Îñòàëüíûå ðåôåðàòû

Ðåôåðàòû ïî àâèàöèè è êîñìîíàâòèêå

Ðåôåðàòû ïî àäìèíèñòðàòèâíîìó ïðàâó

Ðåôåðàòû ïî áåçîïàñíîñòè æèçíåäåÿòåëüíîñòè

Ðåôåðàòû ïî àðáèòðàæíîìó ïðîöåññó

Ðåôåðàòû ïî àðõèòåêòóðå

Ðåôåðàòû ïî àñòðîíîìèè

Ðåôåðàòû ïî áàíêîâñêîìó äåëó

Ðåôåðàòû ïî áèðæåâîìó äåëó

Ðåôåðàòû ïî áîòàíèêå è ñåëüñêîìó õîçÿéñòâó

Ðåôåðàòû ïî áóõãàëòåðñêîìó ó÷åòó è àóäèòó

Ðåôåðàòû ïî âàëþòíûì îòíîøåíèÿì

Ðåôåðàòû ïî âåòåðèíàðèè

Ðåôåðàòû äëÿ âîåííîé êàôåäðû

Ðåôåðàòû ïî ãåîãðàôèè

Ðåôåðàòû ïî ãåîäåçèè

Ðåôåðàòû ïî ãåîëîãèè

Ðåôåðàò: The City of London and its role as a financial centre

Ðåôåðàò: The City of London and its role as a financial centre

he city of London and its role as a financial center

Chapter 1.

Introduction. The Concept of the City of London.

Britain is a major financial centre providing a wide range of specialised services. The country’s economy has for a long time been directed through the great financial institutions which together are known as “The City”, capital “C”, and which are mainly located in the famous “Square Mile” of the City of London.

The “Square Mile” in the Roman Times historically emerged on the Thames as the business and industrial nucleus of the future London. Through centuries of business and religious developments the City assumed its role of the world commercial centre as it is known today . When in the 20th century Great Britain lost its empire and other financial centres got established in the world, the city adapted itself to changed circumstances to remain a world financial leader. The City of London has the greatest concentration of banks in the world (responsible for about a quarter of total international bank lending) , the world’ s biggest insurance market (with about 1/5 of the international market ), a Stock Exchange with a larger listing of securities than any other exchange, and it remains the principal international centre for transactions in a large number of commodities. A large proportion of Britain’s wealth has been invested by the City overseas. The City’s annual foreign income roughly double that of the British manufacturing industries. The above proves the City’s world significance as a financial centre. Geographically the City is a large office area bubbling with life at daytime and comfortably quiet outside the office hours. It’s historical sights like the Tower of London, St Paul’s Cathedral, the Museum of London, the Monument and others as well as the beautifully impressive architecture of the office buildings attract crowds of visitors. The only housing project, the Barbican, provides very expensive accommodation along with an arts centre, a school and some official premises.

Since after the mid - 80s financial and related services have started to expand outside the “Square Mile” though the City of London remains the symbol and actual reality of the country’s power.

C h a p t e r 2

Britain’s Economic and Financial Position Today at Home and Abroad.

Finance and industry of the British economy go hand in hand as industry requires a diversified network of financial institutions to develop successfully. Although Britain’s financial power today exceeds that of the country’s industrial achievement, the country was for years “the workshop of the world”. It still remains a highly industrialised country but the end of the 20th century saw tendencies for the economic decline.

Historically, after two world wars and the loss of its empire Britain found it increasingly difficult to maintain its leading position in Europe. The growing competition from the United States and later Japan aggravated the country’s position.

Britain struggled to find a balance between the governments intervention in the economy and almost completely free-market economy of the United States. The theories of the great British pre-war economist J. M. Keynes stated that capitalist society could only survive if the government controlled, managed and even planned much of its economy. These ideas failed to get Britain out of the image of a country with quiet market towns linked by steam trains puffing slowly through green meadows. Arrival of Margaret Thatcher, the Conservative prime-minister in office between 1979 and 1990, discarded these theories as completely wrong. Mrs. Thatcher claimed that all controls and regulations of the economy should be removed and a market economy should recover. Her targets were nationalised industries. She refused to assist the struggling enterprises of the coal and steal industries which were slimmed down in order to improve their efficiency. In the steel industry, for example, the workspace was reduced from 130000 people to 50000 by 1990s and the production of 1 ton of steel by 1990 took only 3,7 man hours instead of 12 man hours in 1980. The government believed that privatisation would increase efficiency and economic freedom would encourage private initiative. A lot of big publicly owned production and service companies such as British Telecommunications, British Gas, British Airways, Rolls Royce and even British regional Water Authorities were sold into private hands. Britain began to turn into a country of shareholders. Between 1979 and 1992 the proportion of the population owning shares increased from 7 % to 24%.

The Conservative government reduced the income tax from 33% to 25% as an incentive in production. This did not lead to any loss of revenue, since at the lower rates fewer people tried to avoid tax. At the same time the government doubled the VAT on goods and services to 15%. Today it is 17%.

Small business began to increase rapidly. In 1984 for example there was a total of 1.4 million small business though including “the black economy” the figure was nearer to million. Proportionately, however, there were 50% more of them in West Germany and the United States and about twice more in France and Japan.

Many small businesses fail to survive mainly as a result of poor management and also because compared with other European Community Britain offers the least encouraging conditions. But small businesses are important because they can grow into big ones and because they provide over half of the new jobs. It is particularly important because unemployment in Great Britain rose to nearly 2.5 million people and a lot of jobs are part-time.

Energy is a major component of the economy, which depended mainly on coal production until 1975, began to rely on oil and gas discoveries in the north sea. Coal still remains the single most important source of energy, in spite of its relative decline as an industry, so oil and coal each account for about one third of total energy consumption in Britain. Over a number of years British policy makers promoted the idea of energy coming of different sources. One of them was nuclear energy as a clean and safe solution to energy needs. In fact Britain constructed the world’s first large scale nuclear plant in 1956. However, there were a lot of public worries after the US disaster at Three Miles Island and the Soviet disaster in Chernobyl. Also nuclear research and safe technology is proved to be very expensive - by 1990 the real commercial cost of nuclear plant was twice as high that of a coal power station. Renewable energy sources such as wind or solar energy, are planned to provide 1% of the national energy requirements in the year 2000.

Research and development (R&D) in Britain are Mainly directed towards immediate practical problems. In fact British companies spend less on R&D than any European competitors. At the end of the 1980’s, for example 71% of German companies were spending more than 5% of their annual revenue on R & D compared with only 28% of British companies. As a result Britain has been automating more slowly than her rivals. In fact it may be the consequence of Margaret Thatcher’s views on public spending which includes medical service, social spending, education and R&D. “The Iron lady” argued that “if our objective is to have a prosperous and expanding economy, we must recognise that high public spending kills growth of industry”, as money is taken from the productive sector (industry) to be transferred to unproductive part of it. As a result in the 80’s only 6% of Britain’s labour had a university degree against 18% in America, 13% in Japan and 10% in Germany. Technical education has always been compared with Britain’s major competitors. According to government study “ mechanical engineering is low and production engineers are regarded as the Cinderella of the profession”. Very few school leavers received vocational training. Since 1980’s among university graduates the tendency has been to go from the civil service to merchant banking, rather than industry. And according to analysts resulted from the long-standing cultural roots. Public school leavers considered themselves “gentlemen” too long to adjust fast to the changes of time. Efforts are now taken by the labour government to boost technical and enterprise skills in schools. The 1999 Pre-budget report outlined a 10 million pounds for the purpose.

Despite the favourable effect of “Thatcherism” Britain’s economic problems in the 1990s seemed to be difficult. Manufacturing was more efficient but Britain’s balance of payments was unhealthy, imports of manufacturing goods rose by 40%, and British exports could hardly compete with those of its competitors. Car workers in Germany, for instance, could produce a Ford Escort in help the time taken in Britain. In the 90’s among the European countries British average annual productivity per worker took the 6th place. The revenue softened the social problems but distracted Britain from investing more into industry. Many analysts thought that much more should have been invested into engineering production, managerial and marketing before the North Sea oil declined.

The Labour government undertakes to improve the situation. In his Pre-budget report on 9 November 1999 the Chancellor of the Exchequer Gordon Brown set out new economic ambitions for the next decade. Under them Britain will raise its productivity faster than its competitors to close the productivity gap and a majority of Britain’s school and college leavers will go on to higher education.

In the 80s British companies invested heavily abroad while foreign investments in Britain increased too. Today in a speech in Tokyo on 6 September1999 the Foreign Secretary Robin Cook said that “Britain is a chosen country for more investment from Japan than anywhere else in Europe and more than thousand companies operate in the U. K.”

Mr. Cook added that the huge European Market of 370 million people was “the largest single market in the world, a market that is set to expand even further with the arrival of new member states”. In fact he said investment in Britain is the highest bridge into Europe.

Britain as a world leader in “high-tech” industries

One of the three British microprocessor producers was making 70% of British silicon wafers required for new information technology even in the seventies. On Nov.3.1999 Techmark, a new technology market, was launched at the London Stock Exchange. According to Gordon Brown, Chancellor of the Exchequer, Techmark will be the London Stock Exchange “market within a market” for innovative technological companies.

The specialised institutions are agencies created to meet the needs of specific groups of borrowers mostly industrial and commercial - which are not adequately covered by other institutions. They operate in both public and private sectors. In general they offer alternative funding to that provided by banks and building societies. Some of them were set up with Government support and with financial backing from banks and other financial institutions. Some public sector agencies offer financial support to industry in Scotland, Wales, and Northern Ireland.

The main private sector institutions are finance houses and leasing companies, factoring companies, finance corporations and Venture Capital Companies.

Finance houses are major suppliers of hire-purchase finance for the personal sector of short term credit and leasing to the corporate sector.

Leasing companies buy and own equipment required and chosen by businesses and lease it at an agreed rental rate.

Factoring companies provide cash for a company in exchange for the sums they owe. A factoring company buys up a client’s invoices as they arise and finances up to 80% of the value of the invoices; the rest is paid after a period, after deduction of administration and finance charges.

Finance corporations meet the need for medium and long term capital when such funds are not easily or directly available from traditional sources such as the Stock Exchange or banks.

Venture Capital Companies offer medium term and long term equity financing for new and developing businesses when such funds are not readily available from banks and other traditional sources. The British Venture Capital Association has 103 full members, which make up over 99% of the industry.

Financial markets is a collection of sophisticated securities, futures and options the money market, the euro currency market, Lloyd’s insurance market, the foreign exchange market and markets in bullion and commodities.

The Stock Exchange

The origin of the London Stock Exchange goes back to the coffee houses of the seventeenth century where those who wished to invest or raise money bought and sold shares in joint stock companies. Brokers later opened their own subscription Economy of the country has been directed through the City which is the nerve center of the national finance. The greater part of the country’s income comes from invisible exports - operations originating from the City and flowing through its channels.

A large proportion of Britain’s wealth has been invested by the City overseas. A number of banking institutions have their head offices in Britain but operate mainly abroad in particular regions such as Latin America or East Asia through extensive branch networks. The major bank in this sector is Standard Chartered. This shows how the City of London expands its activities beyond the country’s borders; the same goes for the influence of the London Stock Exchange and Commodities Exchanges (particulars of the City of London as a financial center will be dealt with in Chapter three).

Chapter 3.

The City of London as a Financial Center, its Main Institutions.

There has been a long tradition in Britain of directing the economy through the great financial institutions together known as “the City”, which until 1997 were located in the “Square Mile” of the City of London. This remains broadly the case today, though the markets for financial and related services have grown and diversified greatly.

Banks, insurance companies, the Stock Exchange, money markets, commodity shipping and freight markets and other kinds of financial institutions are concentrated in the solemn buildings of the City and beyond its borders. The City of London is the largest financial center in Europe. London is also the world’s largest international insurance market and has the biggest foreign exchange market.

Britain’s financial service industry gives about 6.5 % of its gross domestic products (GDP) and contributes some 35 thousand million pounds a year. The largest contributors are banks, insurance, institutions pension funds, and securities dealers. To help Britain’s financial services to respond to the competition and at the same time to protect the public investment, the Government introduced 3 pieces of legislation to supervise financing the industry: the Financial Services Act (1986), the Building Societies Act (1986) and the Banking Act (1987). Under these acts investment businesses need to be authorized and they have to obey rules set in the legislation. The main responsibility to supervise were the Bank of England, the Building Societies Commission, the Treasury and the Department of Trade and Industry. The Serious Fraud office was set up to investigate and prosecute significant and complex fraud.

The Bank of England.

The Bank of England was established in 1684 by Act of Parliament and Royal Charter as a corporate body. Its entire capital stock was acquired by the Government under the Bank of England Act in 1946. It is the heart of the City of London and Britain’s central bank. The Bank’s main functions are to execute monetary policy, to act as banker to the Government, to issue banknote and to provide central Banking facilities

for the banking system that is the Bank is responsible for the financial system as a whole; it is “lender of last resort”. The Bank’s main objective is to support the Government in achieving low inflation. Unlike some other central banks the Bank can not act independently of the Government. Decisions on changes in the interest rates are taken by the Chancellor of Exchequer. The Bank’s role is to advise the Chancellor and to carry out his decisions. The 1999 (November) interest rate was 5.5%.

As banker to the Government the Bank of England is responsible for managing the National Debt. It has the sole right in England and Wales to issue banknote. The note issue is no longer backed by gold but the Government and other securities. The Scottish and Northern Ireland Banks have limited rights to issue notes and those must be fully covered by holdings of the Bank of England notes. Coins can be provided by the Royal Mint.

The Bank of England can influence money market conditions through discount houses. If on any day there is a shortage of cash in Banking system, the bank relieves the shortage either by buying bills from the discount houses or lending directly to them.

The Bank of England is responsible for supervision of the main wholesale markets in London for money, foreign exchange or gold bullion.

On behalf of the Treasury the Bank manages the Exchange Equalization Account (EEA). Using the resources of EEA the Bank may intervene in the foreign exchange markets to check undue fluctuations in the exchange rate of sterling.

Discount Houses.

The Discount Houses are unique to the City of London (and to Britain as a country). They occupy the central position in the British monetary system. They act as intermediaries between the Bank of England and the rest of the banking sector promoting an orderly flow of funds between the Government and the banks. In return for acting as intermediaries the discount houses have privileged daily access to the Bank of England as “lender of last resort”.

Banks.

Banks in Britain developed from the London gold miths of the 17th century. By the 1920s and the 1930s there were five large clearing banks with a network across the country. In February 1996 there were 539 institutions authorized under the Banking. Act of 1987. In British banking retail banks should be described as dominant.

Retail banks primarily serve personal customers and small to medium-sized businesses. They operate through more than 11.350 branchers offering cash deposits withdrawl facilities and systems for transferring funds. They provide current accounts, deposit accounts various types of loan arrangements and a growing range of financial services.

The main banks in England and Wales are Barklays, Lloyds, Midland, National Westminter and the TSB group. The major Scottish banks are the Bank of Scotland, Clydesdale and Royal Bank of Scotland.

With a relaxation of restrictions on competition among financial institutions major banks have diversified the services they provide. They have lent more money for house purchases, have more interests in leasing and factoring companies, merchant banks, securities dealers, insurance and trust companies. They provide low facilities to industrial companies ands now support a loan guarantee scheme under which 70% of the value of loans to small companies is guaranteed by the Government.

Plastic card technology has revolutionized cash transfer and payments systems. There are around ninety two million plastic cards in circulation in Britain. There are different types of cards but they often combine functions. Cards can be used overseas too to obtain cash from bank ATM ( Automated Teller Machines). Cash machine cards have greatly improved customers’ access to cash. All retail banks and building societies participate in nation wide networks of ATMs. About two thirds of cash now is obtained through Britain’s twenty one thousand ATMs. .A lot of them are located different places at supermarkets, for instance.

Many banks offer electronic payment of cheques, telephone banking, under which customers use a telephone to obtain account information, make transfers or pay bills. Other innovations include computer-based banking (through home computer) services over Internet and video links.

Merchant banks.

The traditional role of merchant banks was to accept bills of exchange, to provide funds for trade and also to raise capital to British companies through the issue of bonds and other securities. These activities continue, but the role of Britain’s merchant banks has diversified enormously in recent years. Although they are called “banks” they are more involved in providing a range of professional services, such as corporate finance and investment management, than in lending money.

Building societies.

Building societies are mutual institutions owned by their savers and borrowers. They have traditionally concentrated on housing finance, long-term mortgage loans against property - most usually houses purchased for occupation. Services have been extended into other areas, including banking, investment services and insurance. The Societies are one of the main places were people deposit their savings - around 60% of adults have a building society saving accounts. Building societies offer a variety of accounts with interest rates related to the time for which a saver is prepared to tie up his money. So they are major lenders for house purchases. Four of the largest Societies are planning to become banks. The largest Societies, the Halifax, Abbey National and Nationwide owe 45% of the total assets of the movement.

National Savings Bank.

The National Savings Bank is run by the department of National Savings. It provides a system of depositing and withdrawing savings at twenty thousand post offices around the country or by post. The National Savings Bank does not offer lending facilities. Its deposits are used to finance the Governments public sector needs.

Investing Institutions.

The investing institutions are those which collect savings and invest them into securities market and other long-term assets. The main investment institutions are insurance companies, pension funds, unit trusts and investment trusts. Together they make a vast resource of funds which are invested in securities and other assets. They own around 58% of British shares. The British insurance industry is highly sophisticated and serves millions of policyholders in Britain and overseas. Policyholders include governments, companies and individuals. The British insurance is the forth largest in the world and in proportion to its GDP is the highest in any country. There are 2 broad categories of insurance: long-term insurance for many years, such as life insurance, permanent health (medical) insurance; and general insurance for a year or less, which covers risks of damage, such as loss of property, accidents and short-term health insurance. In 1995 there were about 830 authorized to carry on insurance business in Britain. The industry as a whole employs some 207.000 people, plus about 126.000 are employed in activities related to insurance.

Lloyd’s is an incorporated society of private insurers in London. Originally it dealt with marine insurance. Today it deals with other classes of insurance, today it deals with other classes of insurance. Long-term life and financial guarantee business is not covered. Insurance brokers as intermediaries are a valuable part of the insurance market. Lloyd’s insurance brokers play an important role in the Lloyd’s market.

Institute of London Underwriters was formed in 1984 as an association for marine underwriters. Today it provides a market where member insurance companies transact marine, energy, commercial transport and aviation insurance business. The Institute issues combined policies in its own name on risks which are underwritten by member companies. About half of the 58 member companies are branches or subsidiaries of overseas companies.

Pension Funds.

Pension Funds collect savings Pension Funds collect savings from occupational pension schemes and personal pension schemes. Pension contributions are invested through intermediaries in securities and other investment markets. Pension fund have a become a major force in securities markets because they hold about 28% of the securities listed on the London Stock Exchange. Total Pension fund assets are very big. To protect them the Pensions Act was introduced in 1995 to increase confidence in the security of the funds.

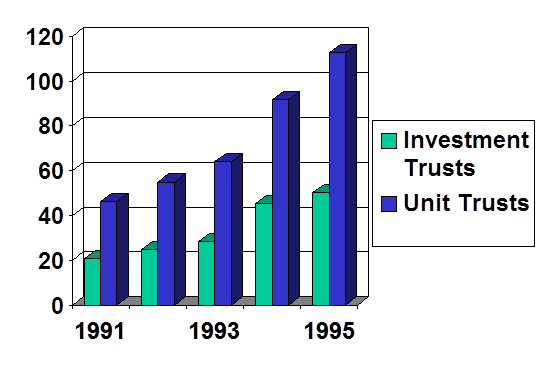

Investment trusts and unit trusts.

Both investment trusts and unit trusts offer investors the opportunity to benefit from pools investments, although their respective structures are somewhat different. Assets have grown considerably in the last few years. So individuals are attracted by the possibility to invest rather small amounts either on a regular basis, usually monthly, or in a lump sum.

Investment trusts companies are companies which are listed on the London Stock Exchange and must invest mostly in securities for the benefit of their shareholders. The trusts are exempt from tax on money which they get within the trusts. Some trusts specialize in particular geographical areas or in particular markets. At the end of June 1996 there were about 350 investment trusts companies listed on the London Stock Exchange.

In unit trusts the investors’ fund are pooled together but are divided into units of equal size. Unit trusts are open ended collective funds where the funds are managed by management groups. The unit trust sector has grown rapidly in recent years. Nearly three million people are estimated to have holdings in unit group.

Specialized institutions.

The origin of the London Stock Exchange goes back to the coffee houses of the 17th century, where those who those who wished to invest or raise money bought and sold shares of joint-stock companies. Brokers later opened their own subscription rooms and in 1773 this was named the Stock Exchange. During the 19th century the Stock Exchange developed as the demand for capitol grew with Britain’s Industrial Revolution. The Exchange also financed the construction of railways, bridges and dams across the world. Today it is one of a number of highly organized financial markets of the City. It provides trading platform and the means of raising capital for British and foreign companies, Government securities, eurobonds and depository receipts. Official list is the Exchanges main market, while AIM, the Exchanges new market is for smaller rapidly growing companies. It opened in 1995. Companies which apply for a listing on the Exchange must provide a full picture of their operations, i9ncluding their financial record, management and business prospects. If a company wants to join AIM the rules are less strict. Such companies include multimedia and high technology business.

Today the Exchange has moved away from face-to-face dealing on the trading floor to system of dealing from member firms’ offices. The quotations are displayed on electronic screen. Before 1986 only British companies were allowed to operate. In 1986 deregulation, known as “the Big Bang” allowed any foreign financial institution to participate in the London money market. Other changes involved a system under which negotiated commissions were allowed instead of fixed rates and dealers are permitted to trade in securities both as principals and as agents. Traditional retail stockbrokers are facing growing competition from operations running by large banks and building societies.

The Exchange has its administrative center in London, with regional offices in Belfast, Birmingham, Glasgow, Leads and Manchester.

Many companies raise new capital on the London money market. The quiet-edged market, that is the market of Government shares, allows the Government to raise money by issuing stock through the Bank of England.

The Exchanges now going through a further period of change which has been described as the most significant period since “The Big Bang”.

Money markets.

London’s money markets channel wholesale short-term funds between lenders and borrows. These operations are conducted by all the major banks and financial institutions. The Bank of England regulates the market. There is no physical market place; negotiations are conducted mostly by telephone or through automated dealing systems. The main financial instruments are CDs (Certificates of Deposit), bills of exchange, Treasury and local authority bills and short-term Government stocks.

Financial Futures and Traded Options.

Financial futures are legal contracts for the purchase or the sale of financial products, on a specified future date at a price agreed in the present. Trading and financial futures developed out of the numerous futures markets in commodities which originate from London’s position as a port and from Britain’s need to import food and raw material.

Options are contracts which give the right to buy or sell financial instruments or physical commodities for a stated period at a predetermined price.

Financial futures and options are traded on the London International Futures and Option Exchange (LIFFE) which was established in 1982..

Commodity Exchanges

Britain remains the principal international center for transactions in a large number of commodities, though the consignments themselves never pass through the ports of Britain. The need for close links with sources of finance, shipping and insurance services often determines the locations of these markets in the City of London. There are futures markets in cocoa, coffee, grains, rubber, sugar, pigmeat, potatoes there.

Gas, oil for heating and petroleum are traded through the International Petroleum Exchange, Europe’s only energy futures exchange.

Copper, lead, zinc, nickel, aluminum, aluminum alloys and tin are treaded through the London Metal Exchange (LME), the world’s largest non-ferrous base metals exchange.

The Baltic Exchange is the world’s leading international shipping exchange. It contributed to 292 Mln pounds in net overseas earnings to Britain’s balance of payments in 1995. Baltic dealers handle more than a half the world’s bulk cargo, transportation of oil, ore, coal and grain. All Britain’s agricultural futures markets are operated from the Baltic Exchange and physical trading and commodities is also carried out there.

Chapter 4.

The International Role of the City of London in the World Monetary and Currency Fields.

A recent comprehensive study of four world cities - London, Paris, New York and Tokyo - confirmed many strength of London and described it as possibly the most international of all world cities. The study said that London and New York are the only two pre-eminent international financial centers with advantages over other cities. One city that is emerging as a financial center of the Asian continent is Tokyo.

Strengths of London include:

1. The concentration of business and service functions - among them support services such as legal services, accountancy, and management consultancy.

2. Efficient world-wide communication links.

3. A favorable position in the time zone between the United States and Far East.

4. A stable political climate.

5. World-class service industries including hotels, restaurants, theaters and other cultural attractions.

Britain and the City of London as a financial symbol, encouraged international liberalization in financial services. It played a major role in negotiating agreements closely connected with GATT (General Agreement of Tariffs and Trade) as well as negotiations within the Organization for Economic Cooperation and Development. Briefly, apart from world-wide insuarence and banking strength, Britain’s important features include:

· Its foreign exchange market,. whose daily turnover of 294 Mln pounds in 1995 represented 30% of Global turnover and was more than the turnover of New York and Tokyo combined.

· The London Stock Exchange which is the biggest trade center for overseas equities in the world; it makes 55% of global turnover.

· The world’s second largest fund management center, after Tokyo.

· One of the world’s biggest markets in financial futures and options.

· One of three largest international bond centers in the world.

Britain’s international role in the world monetary and financial fields became particularly in the late 1980s.

Deregulation has been the main catalyst in increasing the City’s role as an international financial center. Fundamental reforms of 1986, known as Big Bang affected the London Stock Exchange tremendously, because any foreign financial institution can now participate in the London money market. “What we were trying to do”, in the words of a former Deputy Chairman of London Stock Exchange, “ was to create a new market, not one just oriented toward the UK, but one that can become international”. It was intended to secure London as the leading financial center of Europe, and the third in the world alongside New York and Tokyo.

Many foreign banks and finance houses tried to profit from the deregulation, some by direct competition and others by buying long-established City enterprises. Before the Big Bang all City stockbroking firms were British. By 1990 one hundred fifty four out of four hundred and eight were foreign owned. The main investors in British stockbroking are the United States, Japan and France (also see Chapter 2, The Stock Exchange).

British banks, insurance companies, building societies, and other money lenders often prefer to invest in other areas, rather than industry, in contrast with Britain’s competitors, for example Germany and Japan, where the level of industrial development is higher.

Britain strongly supports the removal of national regulations and exchange controls which restrict the creation of common market in financial services. London is a major center for international banking. Altogether five hundred sixty one foreign banks are represented in Britain. They employ about 40.000 people and provide different services in many parts of the world.

Japan and the United States are the two countries with most banks represented in London (see the table attached). Assets/liabilities of overseas banks in Britain have doubled in the last ten years. Overseas banks have a very high proportion of their operations in foreign currency.

Since the end of 1920s the Moscow Narodny Bank has been operating in London to deal with transactions with the Soviet Union and Russia now.

A number of British banks have their head offices in Britain but operate mainly abroad. Standard Chartered is the major bank in this sector: it has a network of over 600 offices in more than 40 countries and employs over 25.000 people. Standard Chartered’s activities are concentrated in Asia, Africa and Middle East.

British banks are developing innovative banking services in their overseas operations. For example Standard Chartered has opened the first fully automated branches in Hong Kong and Singapore. Satellite dishes have been installed in Barclays’ branches in Zimbabwe

London and Tokyo are the main world centers for eurocurrency dealings. The euromarket began with eurodollars - US Dollars lent outside the United States - and now has developed into a powerful market of currencies lent outside their domestic marketplace. Transactions can be carried out in eurodollars, eurodeutschmarks, euroyen, and so on. So, euroloans are short-term trances (three to six months) given by banks at the LIBOR rates. Eurobonds are issued for periods of five to twenty years in currencies other than that of the issuing country.

The London International Futures Exchange trades on the floor of the Royal Exchange building. Over 200 banks and other financial institutions, both British and foreign, are members of the market. In fact over 70% are overseas-owned. They make contracts in British, German, Italian, and Japanese Government bonds.

In 1995 LIFFE announced new linking agreements with the Tokyo International Financial Futures Exchange and Chicago Board of Trade. In 1996 LIFFE merged with the London Commodity Exchange, which is Europe’s primary market for trading futures and options contracts in cocoa, coffee, sugar, wheat, potatoes.

Anyone may deal in gold but, in practice, dealings are largely concentrated in the hands of five members of the London gold market. Around 60 banks and often financial companies participate in the London gold and silver markets. Trading is done by telephone and electronic communications links. The five members of the London Bullion Market Association meet twice daily to establish a London fixing price for Gold and this price is a reference for world-wide gold dealings.

Chapter 5.

Recent Financial Institutions (the London Club, Britain in the IMF, British Banks in Russia).

The International Monetary Fund (IMF) and the London Club can not be properly described as recent institutions but it is important to note their recent activities in the light of the financial problems in Russia.

The IMF was founded in 1944 to secure international monetary cooperation and stabilize exchange rates. Operating funds are subscribed by member Governments according to the volume of their international trade, their national income and their international reserve holdings. Members with temporary difficulties in their international balances of payments may purchase or get credits form the IMF of the foreign exchange they need at fixed rates if they meet the required conditions. Russia applied to the IMF for credits.

Great Britain plays an important role in the IMF. On the 10th of September 1999 the Ñhancellor of the Exchequer Gordon Brown was appointed to the Interim Committee of the IMF. The Committee was established in 1974 to advise the IMF on the management of the international monetary system as well as on dealing with any sudden shock to the world money system. The Chancellor will lead discussions on the reform of the Interim Committee after the proposals of the G7 Finance Ministers.

There will be also discussions on reforms to involve the private sector in presenting the world financial prices. It is the aim of IMF to relieve third world debt to avoid large-scale financial crises.

Among the recent developments it is important to mention the choice of London as the location of NASDAQ-Europe. In his speech on the 5th of November 1999, the Chancellor of the Exchequer Gordon Brown it was excellent news for the City of London to launch a joint venture to create a pan-European security market.

Gordon Brown said: ”NASDAQ’s decision to locate its European exchange here represents a massive vote of confidence in the City. NASDAQ - Europe will strengthen the UK financial services industry and reinforce London’s position as one of the worlds’ top international financial centers”. Mr. Brown added, “NASDAQ’s presence here will be good for the wider economy too, not just in the UK but Europe as a whole. Job creation and economic growth depend on efficient capital markets sending funds to businesses to finance their expansion”.

An important move in the European monetary life was the introduction of a single European currency, the Euro, on the 1st of January 1999. A separate protocol recognizes that Britain is not obliged to join the currency without a separate decision by British Government and Parliament.

So far the Bank of England has not voted to adopt the single currency. On the 6th of September 1999 Mr. Cook , the Foreign Secretary, stated that if the Euro proves to be a success, it would be in Britain’s interest to join it. Britain will first have to test whether there is enough flexibility in British economy and if the Euro will promote strong international investment and boost British financial services industry.

According to the decision of European Union (EU) Heads of Government single currency notes and coins will be introduced at the beginning of 2002 at latest.

The London Club set up in the 1980s under an agreement in London, comprises over 600 big commercial banks whose credits are not covered by government guarantees or insurance. There is a steering committee of the Club which operates between the Club’s sessions. The Sessions are held at the request of the debtors in different cities of the world.

After the collapse of the USSR, the Soviet Union bank for Foreign Economic Affairs owed the London Club a total of over 32 Bln Dollars. Under the latest decision on restructuring the Russian debt it was agreed in February 2000 that the debt would be restructured. Nearly one third of the total amount will be written of and Russia will be allowed to have a grace period of seven years, during which it will pay only reduced interest rates on the remaining sum. In return, the Russian Government undertakes the responsibility for the debt and would be considered defaulting if it fails to meet the stated conditions.

Although the London Club is not entirely a British entity the title speaks for the significance of the city of London.

The world-wide network of British banks is not directly represented on Russian market. Operations available are carried out only through the branches of British banks based in other cities of the world.

Conclusions.

1. Although historically the heart of the financial services sector in Britain was located in the “Square Mile” of the City of London, and this is broadly the case now, financial institutions have moved outside the area all over the country.

2. The City of London is concentration of British financial power which makes London an angle of the New York-Tokyo-London triangular.

3. Though Great Britain is still a leading industrialized nation and a member of G7 group it real power and international influence centers around its financial activities.

Reference list.

1.David McDowall, Britain in close-up/Longman Singapore Publishers Pte Ltd.

2.Britain’s Banking and Financial Institutions/Reference Services, Central Office of Information, London.

3. Angela Fiddles, The City of London (the historic square mile).

4. Talking Points on Britain’s Economy/October 1999, December 1999.

5. Áàíêîâñêîå äåëî, âûïóñê ¹12, 1998ã.

Appendix :

Table 1 .

Net Overseas Earnings of Britain’s Financial Institutions

|

Million Pounds |

|

| Banks | 6,188 |

| Securities Dealers | 1,658 |

| Commodity traders. Bullion dealers and export houses. | 556 |

| Money Market Brokers | 112 |

| Insurance Institutions | 5,952 |

| Pension Funds | 2,044 |

| Unit trusts | 724 |

| Investment Trusts | 383 |

| Fund Managers | 425 |

| Baltic Exchange | 292 |

| Lloyd’s Register of Shipping | 57 |

| Finance Leasing | 40 |

| Non-specified institutions | 1,962 |

| Total | 20,393 |

Table 2.

Notes in circulation.

|

|

Value of notes in circulation end February 1996 (million) |

No of notes issued by denomination in year to end February1996 (million) |

|

1 pound |

56 | - |

|

5 pounds |

1,067 | 336 |

|

10 pounds |

5,688 | 575 |

|

20 pounds |

8,579 | 326 |

|

50 pounds |

3,104 | 43 |

|

Other notes |

1,154 | - |

|

Total |

19,648 | 1,280 |

Source : Bank of England.

Table 3.

Major British Banks 1995.

|

Assets Liabilities (Mln pounds) |

Market Capital (Mln pounds) |

Staff |

Branches |

Cash dispensers and ATMs |

|

| Abbey National | 97,614 | 10,765 | 16,300 | 678 | 1,267 |

| Bank of Scotland | 34,104 | 4,095 | 11,300 | 411 | 463 |

| Barclays | 164,184 | 18,407 | 61,200 | 2,050 | 3,020 |

| Lloyds TSB | 131,750 | 25,496 | 66,400 | 2,858 | 4,346 |

| Midland | 92,093 | 39,658 | 43,400 | 1,701 | 2,282 |

|

National Westminster |

166,347 | 13,548 | 61,000 | 2,215 | 2,998 |

| Royal Bank of Scotland | 50,497 | 4,750 | 19,500 | 687 | 1,009 |

|

Standard Chartered |

38,934 | 7,757 | 1,100 | 1 | - |

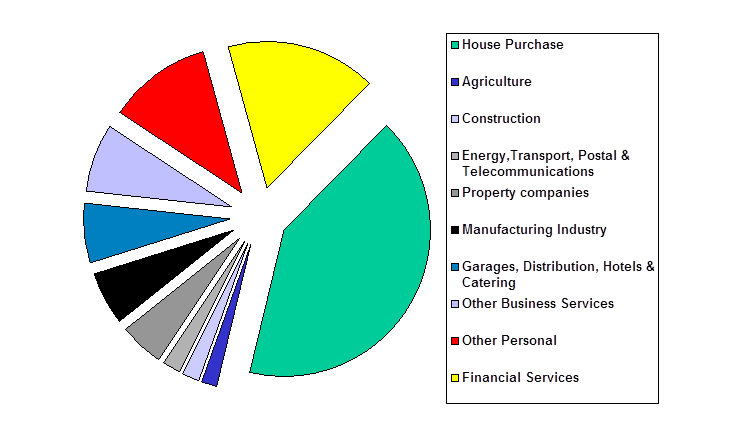

Figure 1.

Major Banks lending to British Residents December 1995.

Table 4.

Largest Building Societies.

|

Rank by Group Assets |

Rank After Flotations and Mergers in 1977 |

Group Assets (million pounds) |

| 1. Halifax. | - | 98,655 |

| 2. Nationwide. | 1 | 35,742 |

| 3.Woolwich | - | 28,005 |

| 4. Alliance & Leicester | - | 22,846 |

| 5. Bradford & Bingley | 2 | 15,658 |

| 6. Britannia | 3 | 14,916 |

| 7.National & Provincial | - | 14,133 |

| 8.Northern Rock | - | 11,559 |

| 9.Bristrol & West | - | 8,589 |

| 10. Birmingham Mdshires | 4 | 6,725 |

| 11. Yorkshire | 5 | 6,412 |

| 12.Portman | 6 | 3,513 |

| 13.Coventry | 7 | 3,379 |

| 14.Skipton | 8 | 3,037 |

Table 5.

Overseas Banks in Britain

(Main Countries Represented).

|

Country of origin |

Branches of an Overseas Bank |

British Incorporated Subsidiary of an Overseas Bank |

Representative offices |

Other |

Total |

|

France |

16 | 8 | 23 | - | 47 |

|

Germany |

19 | 5 | 4 | - | 28 |

|

Italy |

15 | 1 | 28 | - | 44 |

|

Japan |

28 | 6 | 15 | 4 | 53 |

|

Switzerland |

9 | 2 | 17 | - | 28 |

|

United States |

23 | 9 | 11 | 6 | 49 |

|

Other countries |

153 | 41 | 111 | 7 | 312 |

|

Total |

263 | 72 | 209 | 17 | 561 |

Source: Bank of England.

Table 6.

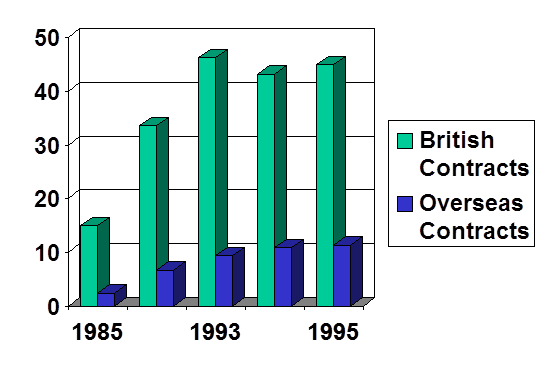

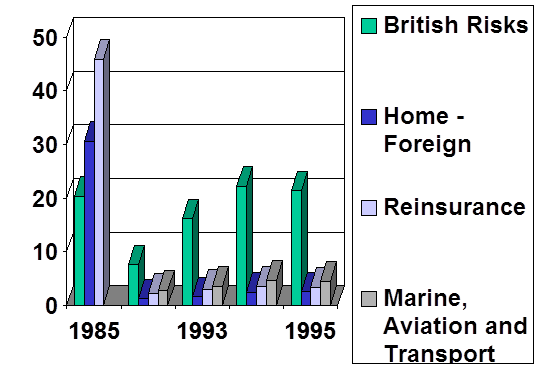

General and Long-term Insurance Business 1985 - 1995.

General Insurance net premiums.

Table 7.

Growth in Unit Trusts and Investment Trusts.

Definitions.

|

Assets - |

anything owned by an individual, company, legal body or government which has a cash value. |

|

Big Bang - |

a system of major changes which brought deregulation to the London Stock Exchange in 1986. |

|

Bill of Exchange - |

an officially signed promise to pay to the receiver of the bill, the stated at the fixed time. |

|

Bond - |

a certificate issued by the borrower as a receipt for a loan usually longer than 12 months; it indicates the interest rate and the date of repayment. |

|

Eurobond- |

an international certificate issued by the borrower for a long-term loan (from 5 to 15 years) in any European currency but not in the currency of the issuing bank. |

|

Securities- |

general term for stocks and shares of all types. |

|

Exchange- |

a market for the toll purchase of goods or securities. |

|

Stock Exchange- |

a market for short or long term transactions in securities . |

|

Commodity Exchange- |

a stable market for wholesale transactions in preferably commodities and raw materials |

|

Money Market- |

a market for money instruments with a period of validity of less than one year. |

|

Factoring- |

a business activity in which a company takes over the responsibility for collecting the debts of another company. |

|

Fund Management- |

managing investors’ funds on their behalf or advising investors on how to invest their funds. |

|

Financial Futures- |

legal contracts for the sale or purchase of financial products on a specified future date, at the price agreed in the present. |

|

Option- |

A contract giving the right to buy or sell financial instruments or goods for a stated period at a stated price. |

|

The London Bullion Market - |

The international gold and silver market in London where trade is done by a telephone or electronic links. |

|

Hedge |

The purchase or sale futures contract as a temporary substitute for a transaction to be made at a later date |

|

Open-Ended Fund- |

A fund without a fixed number of shares |

|

Quite-edged loans - |

Loans issued on behalf of the Government to fund its spending. |